Unlocking the Magic of Disney: A Deep Dive into Disney Stock Price Quote and Rating

BlogTable of Contents

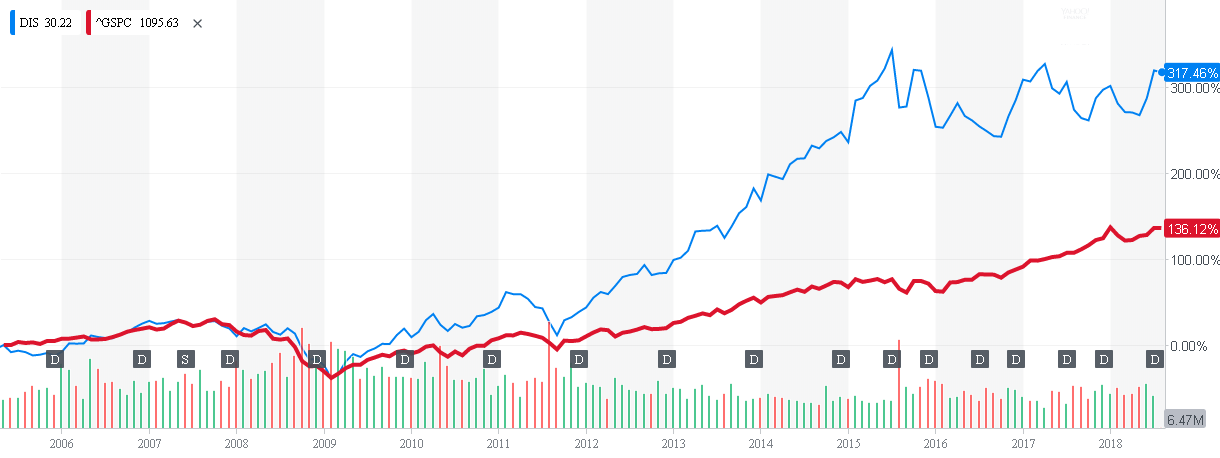

- Disney Stock

- Disney Stock: Capital Structure Analysis (DIS)

- Disney Stock Price Prediction: Will DIS Break Below ? - The Coin ...

- Going Into Earnings, Is Disney Stock a Buy? | Morningstar

- Walt Disney Quote - DIS | ADVFN

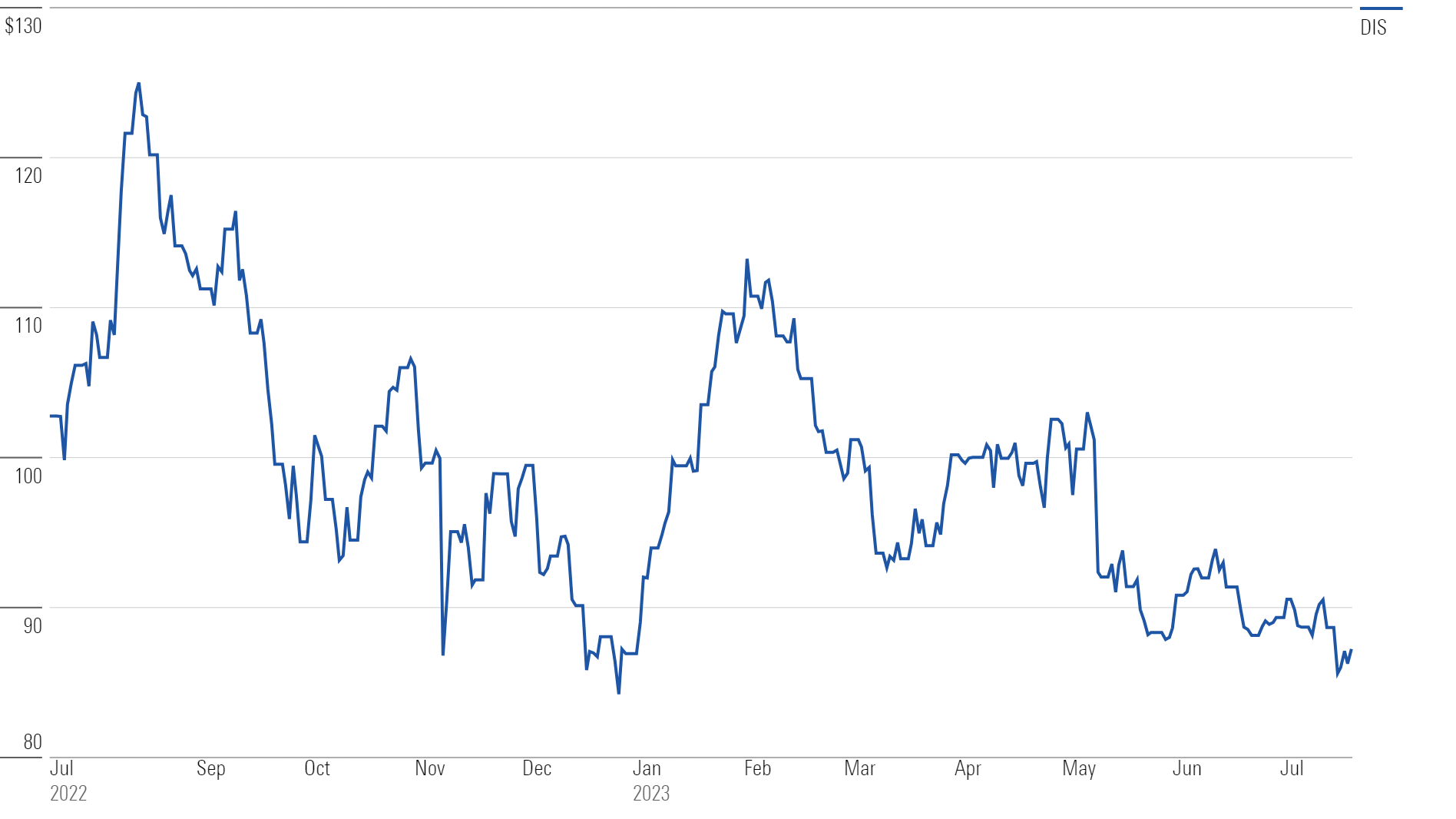

- Disney Stock Closes at Lowest Point in Nearly Nine Years

- The Time To Buy Disney Is Now (NYSE:DIS) | Seeking Alpha

- The Walt Disney Company Stock Certificate 2011 - 1 Novelty Share Art ...

- Disney Stock Drops To Under After Reports 'Avatar: The Way of Water ...

- Disney Stock Dives to Multi-Year Low After Earnings Report, Analysts ...

Current Disney Stock Price Quote

/GettyImages-880238948-de3f8c6d4afe4e6285f672940f0b8937.jpg)

Morningstar Rating: A Seal of Approval

Disney's Business Segments: A Diversified Portfolio

The Walt Disney Company operates through several business segments, including: Media Networks: comprising cable networks such as ESPN, ABC, and Disney Channel Parks and Resorts: including theme parks, resorts, and cruise lines Studio Entertainment: encompassing film and television production and distribution Consumer Products and Interactive Media: covering merchandising, licensing, and digital media This diversified portfolio has enabled Disney to mitigate risks and capitalize on opportunities across various industries, contributing to its stable financial performance.

Growth Prospects: Expanding into New Frontiers

Disney's growth prospects are promising, driven by its strategic expansion into new markets and technologies. The company's acquisition of 21st Century Fox has bolstered its content library and enhanced its position in the global entertainment landscape. Furthermore, Disney's foray into streaming services, including Disney+ and Hulu, has opened up new revenue streams and enabled the company to tap into the growing demand for online content. The Disney stock price quote and rating provide a snapshot of the company's current performance and future prospects. With its diversified portfolio, strategic expansion, and commitment to innovation, Disney remains a compelling investment opportunity. As the entertainment industry continues to evolve, investors can rely on Morningstar's rating and analysis to make informed decisions about their investment in Disney stock. Whether you're a seasoned investor or a newcomer to the stock market, the magic of Disney is sure to captivate and inspire.Stay up-to-date with the latest Disney stock price quote and rating from Morningstar, and discover the investment potential of this iconic company.

Note: The current stock price, market capitalization, and Morningstar rating may fluctuate and are subject to change. This article is for informational purposes only and should not be considered as investment advice.