Understanding Oil Prices: A Comprehensive Guide to WTI and Brent Oil Price Charts

BlogTable of Contents

- Live Crude Oil Chart

- Crude oil prices continue to rise

- Oil price - MahamThanasis

- Oil prices chart by month information | scarlettint

- Historical Crude Oil Prices – Energy History

- Historical Crude Oil Prices – Energy History

- Shell takes bn hit over low oil prices - BBC News

- Oil prices in the world market today

- Oil Price Index Live Chart Today (Sep 14) - oftrb.com

- US Oil Stocks Decline - Oil Prices Rise

Oil prices have been a significant factor in the global economy, influencing everything from fuel costs to economic growth. The two most widely used benchmarks for oil prices are West Texas Intermediate (WTI) and Brent oil. In this article, we will delve into the world of oil prices, exploring the WTI and Brent oil price charts, and what they mean for the markets.

What are WTI and Brent Oil?

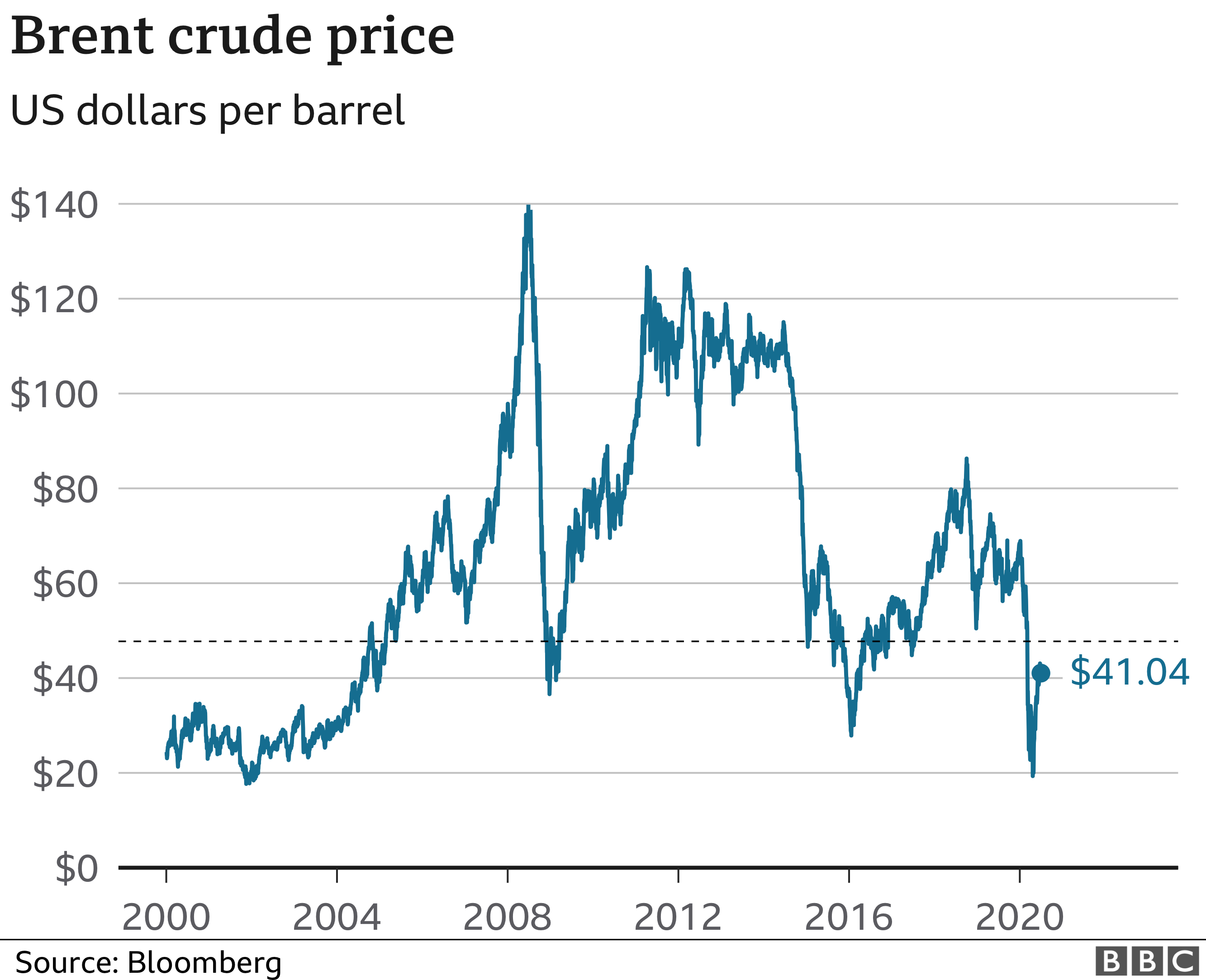

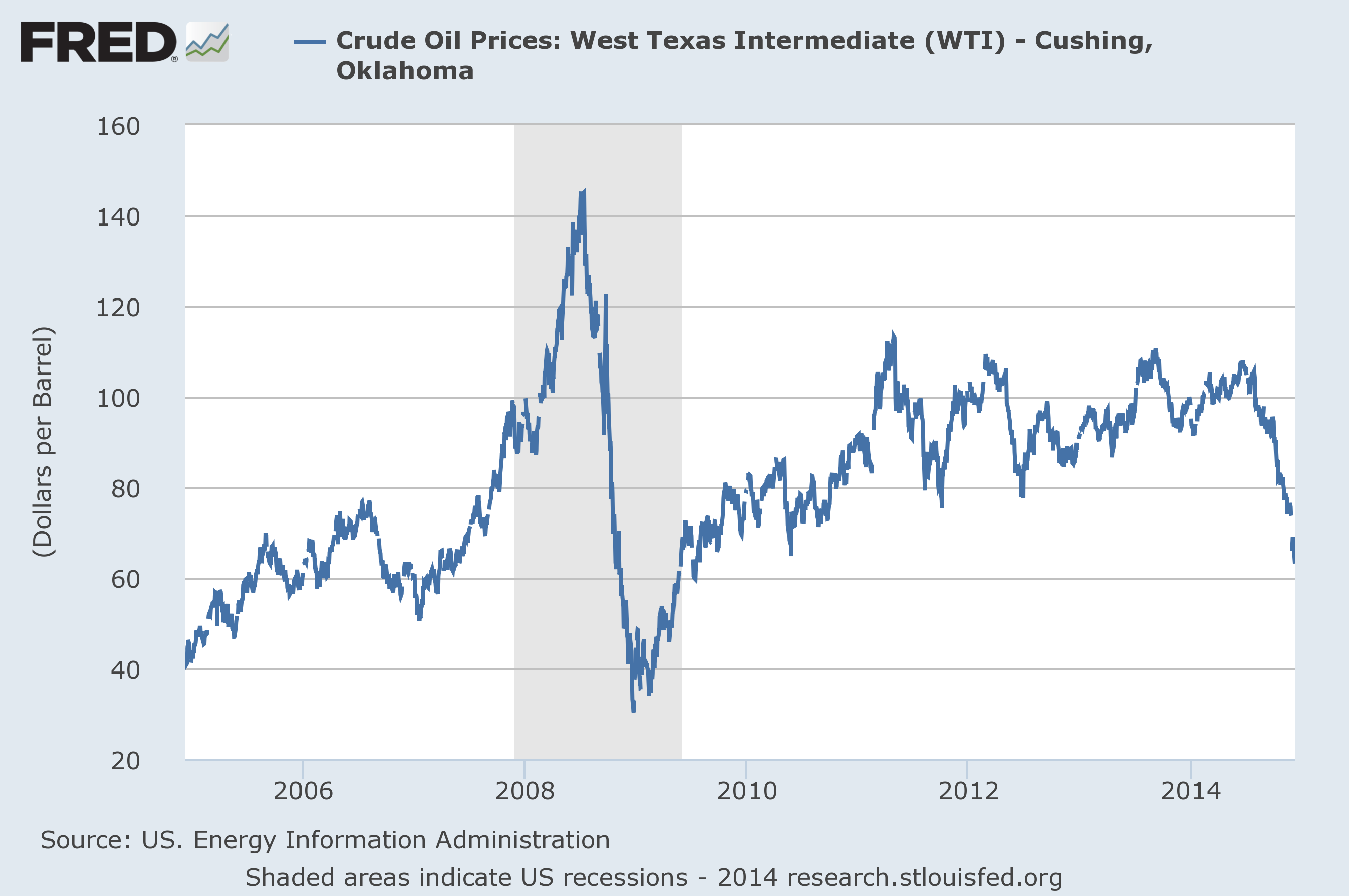

West Texas Intermediate (WTI) and Brent oil are two types of crude oil that serve as benchmarks for oil prices. WTI, also known as West Texas Light, is a light crude oil extracted from the Permian Basin in the United States. Brent oil, on the other hand, is a light crude oil extracted from the North Sea. The main difference between the two is their API gravity, with WTI being lighter and sweeter (lower sulfur content) than Brent oil.

WTI and Brent Oil Price Charts

The WTI and Brent oil price charts are used to track the current and historical prices of these two types of crude oil. The charts are updated in real-time, reflecting the current market prices. The prices are influenced by a variety of factors, including global demand, supply and demand imbalances, geopolitical events, and currency fluctuations. You can find the latest WTI and Brent oil price charts on financial websites such as Markets Insider.

Key Factors Affecting Oil Prices

Several factors contribute to the fluctuations in oil prices, including:

- Global Demand: An increase in global demand for oil can lead to higher prices, while a decrease in demand can lead to lower prices.

- Supply and Demand Imbalances: Disruptions to oil production, such as natural disasters or conflicts, can lead to supply shortages and higher prices.

- Geopolitical Events: Political instability, sanctions, and conflicts in oil-producing countries can impact oil prices.

- Currency Fluctuations: Changes in currency exchange rates can affect the price of oil, as it is typically priced in US dollars.

Impact of Oil Prices on the Economy

Oil prices have a significant impact on the global economy, influencing:

- Fuel Costs: Higher oil prices can lead to increased fuel costs, affecting transportation and energy costs.

- Inflation: Rising oil prices can contribute to inflation, as higher energy costs are passed on to consumers.

- Economic Growth: High oil prices can slow down economic growth, while low oil prices can stimulate growth.

In conclusion, understanding oil prices and the WTI and Brent oil price charts is essential for investors, businesses, and individuals alike. By monitoring the charts and staying informed about the factors that influence oil prices, you can make informed decisions about investments, energy costs, and economic growth. Whether you're a seasoned investor or just starting to explore the world of oil prices, staying up-to-date with the latest developments is crucial in today's fast-paced market.

Stay ahead of the curve with the latest WTI and Brent oil price charts and news on Markets Insider. With real-time updates and in-depth analysis, you'll be well-equipped to navigate the complex world of oil prices and make informed decisions.