As the new financial year approaches, Australian taxpayers are eager to understand the changes and updates to the tax brackets for the 2024-25 period. The Australian Taxation Office (ATO) has announced the tax rates and brackets for the upcoming year, and it's essential for individuals to be aware of these changes to plan their finances effectively. In this article, we'll provide a complete guide to the 2024-25 tax brackets, highlighting the key changes and implications for Australian taxpayers.

Understanding Tax Brackets in Australia

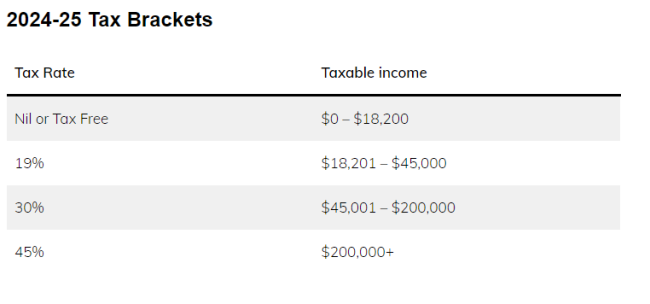

In Australia, the tax system is based on a progressive tax scale, where individuals are taxed at different rates depending on their taxable income. The tax brackets are adjusted annually to account for inflation and other economic factors. The 2024-25 tax brackets are as follows:

- 0 - $18,201: 0% (tax-free threshold)

- $18,201 - $45,000: 19% (basic tax rate)

- $45,001 - $120,000: 32.5% (middle tax rate)

- $120,001 - $180,000: 37% (higher tax rate)

- $180,001 and above: 45% (top tax rate)

Changes to Tax Brackets for 2024-25

Compared to the previous financial year, the 2024-25 tax brackets have undergone some changes. The tax-free threshold remains the same, but the basic tax rate of 19% now applies to a wider income range ($18,201 - $45,000). The middle tax rate of 32.5% has also been adjusted, applying to incomes between $45,001 and $120,000.

Implications for Australian Taxpayers

The updated tax brackets for 2024-25 have significant implications for Australian taxpayers. Individuals with taxable incomes below $45,000 will benefit from the lower tax rate, while those with higher incomes will be subject to the increased tax rates. It's essential for taxpayers to review their financial situation and adjust their tax planning strategies accordingly.

Tax Planning Strategies for 2024-25

To minimize tax liabilities and maximize refunds, Australian taxpayers can consider the following tax planning strategies:

- Contribute to superannuation: Making voluntary superannuation contributions can help reduce taxable income and lower tax liabilities.

- Claim deductions: Claiming eligible deductions, such as work-related expenses and charitable donations, can help reduce taxable income.

- Utilize tax offsets: Tax offsets, such as the low-and-middle-income tax offset (LMITO), can provide additional tax savings.

The 2024-25 tax brackets in Australia have undergone changes, and it's crucial for taxpayers to understand these updates to plan their finances effectively. By being aware of the tax rates and brackets, individuals can make informed decisions about their tax planning strategies and minimize their tax liabilities. As the new financial year approaches, it's essential for Australian taxpayers to review their financial situation and seek professional advice if needed to ensure they're taking advantage of the available tax savings opportunities.

Note: The information provided in this article is general in nature and should not be considered as tax advice. It's always recommended to consult with a tax professional or financial advisor to ensure you're meeting your specific tax obligations and taking advantage of available tax savings opportunities.